Equity Management Solutions

Fidelity helps companies position themselves for successful equity financings and exits by combining holistic equity management, corporate governance, fundraising tools, and documentation into a single collaborative platform.

A holistic, automated approach to equity management

%20(DASHBOARDS).png?width=2000&height=1125&name=CAPITALIZATION%20TABLE%20(COMBINED)%20(DASHBOARDS).png)

The platform features a comprehensive suite of equity management tools, including a dynamic stock ledger and capitalization table that are up-to-date to help provide a clear picture of your equity landscape.

.png?width=2000&height=1125&name=CAPITALIZATION%20TABLE%20(DASHBOARD).png)

Cap Table Management

With Fidelity Private Shares, your cap table and all the documents in your data room are tied together using a smart-linking feature.

This real-time connection can help you operate more efficiently and enable accurate report generation, next round planning, and scenario models.

.png?width=2000&height=1125&name=DATA%20ROOM%20(COMBINED).png)

409A Valuations

We bring you integrated 409A valuations to establish Fair Market Value for stock option grants.

Collecting all the required documentation can be a time-consuming activity.

With our platform, that process is streamlined, and you get faster, more accurate, and competitively-priced 409A from our industry-vetted collaborators.

.png?width=2000&height=1125&name=Next%20Round%20Planner(DASHBOARD).png)

Fundraising & Scenario Modeling

Time to raise money? We’re here for you. Let us take some of the ambiguity out of the term sheet so you can focus on the things that matter.

Because we leverage standard documents, you can close deals in days, rather than weeks.

Plus, our platform can capture your deal with all of its nuances and make it a part of your company’s institutional history. Your cap table and all other systems may accurately reflect the deal.

.png?width=2000&height=1125&name=AUTOMATED%20DATA%20ROOM%20(DASHBOARD).png)

Automated Data Room

With every action you take in the platform, we automatically organize your documents in a secure, searchable Data Room to help keep your company investor ready every day.

The user experience is intuitive, and you decide exactly who should have access to view, edit, or share your company's documents.

Our real-time reporting logs all activity so you can track anyone accessing your documents, and you can get notifications about document changes, downloads, and other diligence activity within the data room.

.png?width=2000&height=1125&name=HR%20ONBOARDING%20(COMBINED).png)

HR Onboarding

Need to hire and manage employees? We can help.

Fidelity offers centralized employee information management and a range of HR features, including standard and custom onboarding forms, employee reports, and personnel data.

And when it’s time for your next fundraising, all of your IP assignment and employment agreements can be organized and ready to go.

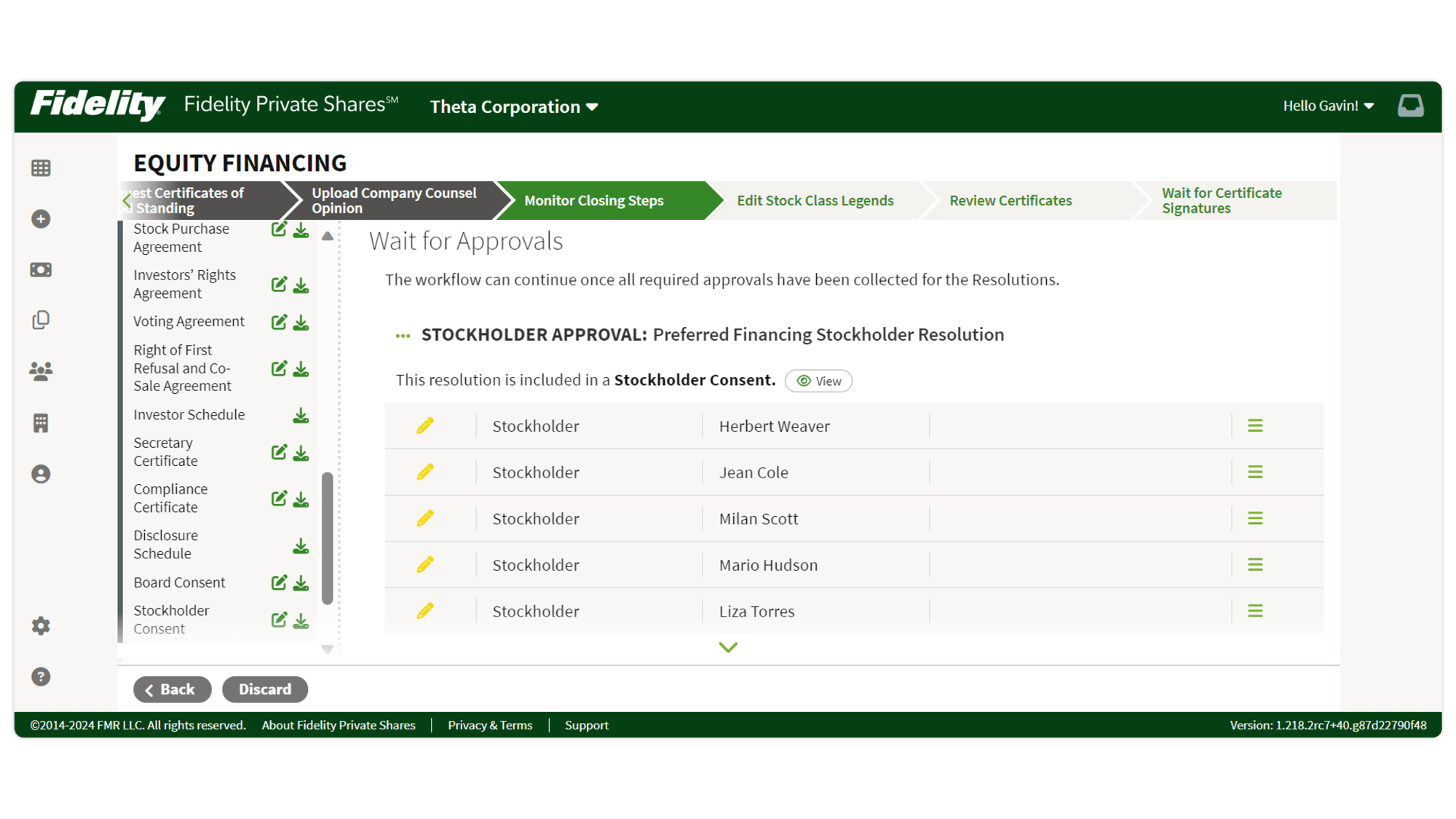

Automated Equity Financing

Manage all the pieces of your fundraise in a single platform, including:

- accurate cap table with quick links to relevant documents

- model your round based on real-time cap table data

- draft fundraising documents and negotiate

- execute and monitor stakeholder approvals

- generate documents through flexible workflows

Collaborate with all your stakeholders – attorney, investors, and startup leaders – and get from term sheet to close faster, typically in less than 14 days.

.png?width=2000&height=1125&name=Board-of-directors%20(DASHBOARD).png)

Board & Stockholder Relations

From consents to board minutes to stockholder communications, your company operations can be safe, secure, and beautifully organized.

Fidelity offers you a single place to help manage the approval process and securely store your records.

When a board consent is created, the appropriate parties are automatically invited to sign. Then, the document is executed and stored.

Review the signature status and next steps for each person.

.png?width=2000&height=1125&name=COMPANY%20FORMATION%20(COMBINED).png)

Company Formation & Incorporation

Incorporating as a Delaware C Corporation couldn't be easier. Create your company's charter and file it with Delaware. Establish the structure of your new company from board members to initial company ownership. It can take just 15 minutes, and costs just $400, which includes all Delaware filing fees.

Simple & Risk-free Equity Management

If it’s involved in equity management, there’s a corresponding workflow. We handle:

- Stock Incentive Plan, including amendments

- Option grants and exercises

- Automated vesting schedules

- Early exercise of options

- Electronic stock certificates, including tracking and managing legends

- Note and SAFE conversion

- Warrant management

- Preferred stock, including tracked liquidation preferences

- Stock transfer generation

- Stock repurchase (including termination support for repurchases)

- Post-termination exercise window management

- Capitalization table

- Stock ledger

- Exit waterfall modeling

- Next round planner with pro forma export

- Historical capitalization tables

- Summary cap table for investors

- Transaction reports: grant history report, transfer report, option overhang report

- 83(b) report

- Customizable permissioning for access to equity data

- Grant approvals (including board consents and meeting minutes) and lineage tracking

- Electronic signatures

- Legal review of equity grants

- Lawyer access to cap table and grant documents

- Secure and organized automated data room

- Diligence support for auditors and investors

- Employee portal to review equity grants and documentation

- Track grant vesting

- Exercise option grants

- Exercise cost calculation

- 83(b) elections

- Form 3921 management

- ASC 718 reports

- 83(b) election reminders and document generation

- Automatic constraint checks: Rule 701 compliance, IRS limits on ownership, and available shares

Interested in learning more?

Fidelity helps companies position themselves for successful equity financings and exits by combining holistic equity management, corporate governance, fundraising tools, and documentation into a single collaborative platform.

409a valuations are conducted by a third party.

1124300.1.0